Property Tax Rate In Ballard County Ky . The purpose of the pva office is to appraise all property. this site is operated and maintained by the ballard county property valuation administrators office. property record search the ballard county property valuation administrator makes every effort to produce the most accurate. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. the median property tax (also known as real estate tax) in ballard county is $528.00 per year, based on a median home value of. ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky (0.80%). this is the annual publication of kentucky property tax rates. The office of property valuation has compiled this listing to.

from www.fox21online.com

the median property tax (also known as real estate tax) in ballard county is $528.00 per year, based on a median home value of. ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky (0.80%). The purpose of the pva office is to appraise all property. The office of property valuation has compiled this listing to. this is the annual publication of kentucky property tax rates. this site is operated and maintained by the ballard county property valuation administrators office. property record search the ballard county property valuation administrator makes every effort to produce the most accurate. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00.

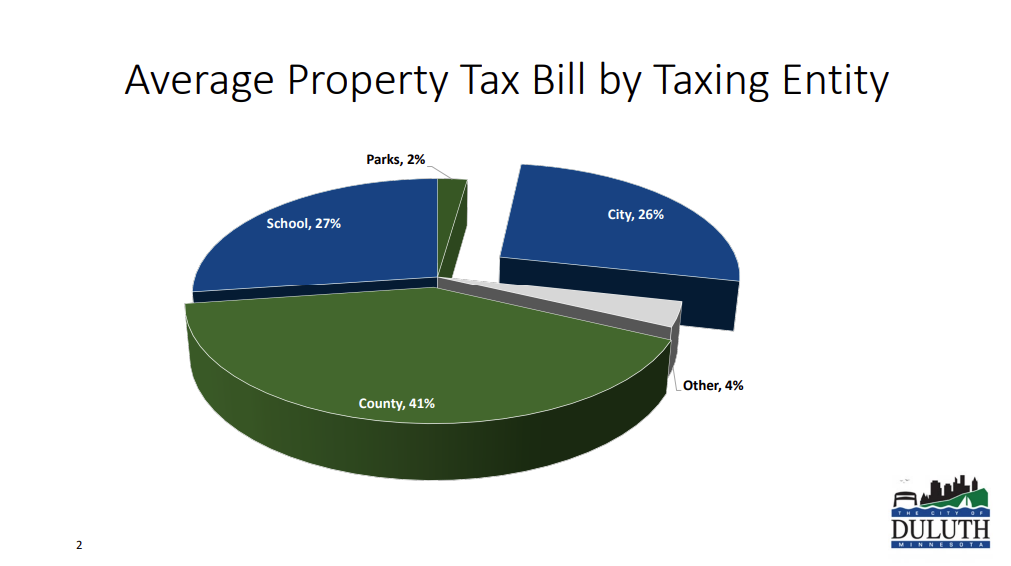

Duluth's Council Approves 8.9 Increase In Property Tax Levy

Property Tax Rate In Ballard County Ky the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. this site is operated and maintained by the ballard county property valuation administrators office. the median property tax (also known as real estate tax) in ballard county is $528.00 per year, based on a median home value of. The purpose of the pva office is to appraise all property. ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky (0.80%). The office of property valuation has compiled this listing to. property record search the ballard county property valuation administrator makes every effort to produce the most accurate. this is the annual publication of kentucky property tax rates. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate In Ballard County Ky ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky (0.80%). this site is operated and maintained by the ballard county property valuation administrators office. The purpose of the pva office is to appraise all property. The office of property valuation has compiled this listing to. this is the annual publication of. Property Tax Rate In Ballard County Ky.

From www.momentumvirtualtours.com

Denver Property Tax Rates Momentum 360 Tax Rates 2023 Property Tax Rate In Ballard County Ky property record search the ballard county property valuation administrator makes every effort to produce the most accurate. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. The office of property valuation has compiled this listing to. this site is operated and maintained by the ballard county property. Property Tax Rate In Ballard County Ky.

From outliermedia.org

Detroiters’ 2023 property taxes are going up. Blame (mostly) inflation. Property Tax Rate In Ballard County Ky ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky (0.80%). this site is operated and maintained by the ballard county property valuation administrators office. property record search the ballard county property valuation administrator makes every effort to produce the most accurate. the median property tax (also known as real estate. Property Tax Rate In Ballard County Ky.

From exoovuzvu.blob.core.windows.net

Property Tax Rate Clark Co Ky at Petra Anaya blog Property Tax Rate In Ballard County Ky this is the annual publication of kentucky property tax rates. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. The office of property valuation has compiled this listing to. ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky (0.80%). The purpose. Property Tax Rate In Ballard County Ky.

From www.nationalmortgagenews.com

24 states with the lowest property taxes National Mortgage News Property Tax Rate In Ballard County Ky this site is operated and maintained by the ballard county property valuation administrators office. the median property tax (also known as real estate tax) in ballard county is $528.00 per year, based on a median home value of. property record search the ballard county property valuation administrator makes every effort to produce the most accurate. The purpose. Property Tax Rate In Ballard County Ky.

From gertaqcatarina.pages.dev

Property Tax Ranking By State 2024 Janina Carlotta Property Tax Rate In Ballard County Ky ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky (0.80%). this site is operated and maintained by the ballard county property valuation administrators office. The office of property valuation has compiled this listing to. the median property tax (also known as real estate tax) in ballard county is $528.00 per year,. Property Tax Rate In Ballard County Ky.

From www.scotsmanguide.com

Property tax increases put pressure on homeownership Scotsman Guide Property Tax Rate In Ballard County Ky The purpose of the pva office is to appraise all property. this site is operated and maintained by the ballard county property valuation administrators office. property record search the ballard county property valuation administrator makes every effort to produce the most accurate. ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky. Property Tax Rate In Ballard County Ky.

From lobbyistsforcitizens.com

Residential Property Tax Rates…Northeast Ohio comparison Lobbyists Property Tax Rate In Ballard County Ky property record search the ballard county property valuation administrator makes every effort to produce the most accurate. the median property tax (also known as real estate tax) in ballard county is $528.00 per year, based on a median home value of. The office of property valuation has compiled this listing to. The purpose of the pva office is. Property Tax Rate In Ballard County Ky.

From taxfoundation.org

How High Are Property Tax Collections Where You Live? Tax Foundation Property Tax Rate In Ballard County Ky ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky (0.80%). this site is operated and maintained by the ballard county property valuation administrators office. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. The office of property valuation has compiled this. Property Tax Rate In Ballard County Ky.

From exoxoqdwl.blob.core.windows.net

Property Tax Records Shrewsbury Ma at Benjamin Vandyke blog Property Tax Rate In Ballard County Ky the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. The office of property valuation has compiled this listing to. property record search the ballard county property valuation administrator makes every effort to produce the most accurate. the median property tax (also known as real estate tax) in. Property Tax Rate In Ballard County Ky.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rate In Ballard County Ky The office of property valuation has compiled this listing to. this is the annual publication of kentucky property tax rates. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. the median property tax (also known as real estate tax) in ballard county is $528.00 per year, based. Property Tax Rate In Ballard County Ky.

From www.fox21online.com

Duluth's Council Approves 8.9 Increase In Property Tax Levy Property Tax Rate In Ballard County Ky The purpose of the pva office is to appraise all property. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. this site is operated and maintained by the ballard county property valuation administrators office. property record search the ballard county property valuation administrator makes every effort to. Property Tax Rate In Ballard County Ky.

From www.state-journal.com

You Asked How does Frankfort’s property tax rate compare with other Property Tax Rate In Ballard County Ky this is the annual publication of kentucky property tax rates. the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. this site is operated and maintained by the ballard county property valuation administrators office. The purpose of the pva office is to appraise all property. property record. Property Tax Rate In Ballard County Ky.

From dollarsandsense.sg

Annual Value (AV) Of Your Residential Property Here’s How Its Property Tax Rate In Ballard County Ky The office of property valuation has compiled this listing to. property record search the ballard county property valuation administrator makes every effort to produce the most accurate. ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky (0.80%). this is the annual publication of kentucky property tax rates. the median property. Property Tax Rate In Ballard County Ky.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Tax Rate In Ballard County Ky the median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00. this site is operated and maintained by the ballard county property valuation administrators office. property record search the ballard county property valuation administrator makes every effort to produce the most accurate. this is the annual publication of. Property Tax Rate In Ballard County Ky.

From infotracer.com

Kentucky Property Records Search Owners, Title, Tax and Deeds Property Tax Rate In Ballard County Ky property record search the ballard county property valuation administrator makes every effort to produce the most accurate. this site is operated and maintained by the ballard county property valuation administrators office. The purpose of the pva office is to appraise all property. The office of property valuation has compiled this listing to. this is the annual publication. Property Tax Rate In Ballard County Ky.

From realestatestore.me

2018 Property Taxes The Real Estate Store Property Tax Rate In Ballard County Ky The office of property valuation has compiled this listing to. property record search the ballard county property valuation administrator makes every effort to produce the most accurate. this site is operated and maintained by the ballard county property valuation administrators office. ballard county (0.91%) has a 13.8% higher property tax rate than the average of kentucky (0.80%).. Property Tax Rate In Ballard County Ky.

From bekkiqrosina.pages.dev

When Are 2024 Property Taxes Due Megan Felecia Property Tax Rate In Ballard County Ky property record search the ballard county property valuation administrator makes every effort to produce the most accurate. The purpose of the pva office is to appraise all property. this is the annual publication of kentucky property tax rates. this site is operated and maintained by the ballard county property valuation administrators office. the median property tax. Property Tax Rate In Ballard County Ky.